Investing Made Easy

So hopefully you've read my previous blog post that covered how to make the most out of business travel which laid out some nice tips to maximize those businessman perks. Also, you must read my second post that walked you through creating your budget which is honestly the most important step of all. Now you made your budget, you've paid off all debt that is charging high interest, you're getting creative with your spending, you know exactly how much you’re saving, and you're done...WRONG.

If you thought a spreadsheet detailing your spending was intimidating, wait till you decide you want to start investing. Where do I go, how much money do I need to begin, I buy all Apple stock right, why invest anyways? These are the types of questions that scare and/or confuse people which either causes them to put off investing until the all illusive “later” or make some knee jerk decisions...trust me I've done both. In this post I will introduce you to some great tools as well as helping you avoid rookie mistakes I’ve made myself.

The Ultimate Enemy Is Inflation

The first step is admitting you have a problem. Your problem is the ultimate enemy and its name is inflation. Inflation is basically how much more would the same thing cost you today versus last year. This number is not created based off of one item but is instead based off a large list to try and capture the total increase in goods. I think we all understand that $20 today doesn't buy you as much as it did in 1950.

In fact $20 in 1950 is equal to $198 today. Imagine rolling through Taco Bell and ordering off the 10 cent menu. So what? Well the "so what" is that $100 in a given year will on average have the buying power of just $97 the following year because historically inflation is 3%. Every year you let your money just sit there in the bank you are in fact losing money. You now know your problem so let’s begin to outline the solution.

Make That Money Work

You need your money to work for you harder than inflation is working against you. That delta between inflation and the returns on your investments is the amount of money you will get to live off of without touching your principle when you are retired and no longer have regular income. If you have $1,000,000 in investments, inflation is 3%, and your investments earn 7%, then that means you can spend 4% (that’s the delta I mentioned) or $40,000 every year and never even touch the $1,000,000.

This delta between inflation and returns is also a huge part to reaching retirement. Let's say Mr. Dumb puts away $10,000 into a savings account which has practically 0% returns and Mr. Smart puts that $10,000 into an investment account that averages returns of 7%. Keep in mind that both are dealing with 3% inflation. Mr. Dumb and Mr. Smart wait 30 years and compare their numbers. In the end Mr. Dumb's account went from $10,000 in buying power to $4,010 while Mr. Smarts buying power grew to $32,400.

Mr. Smart now has eight times more buying power than Mr. Dumb. The reason Mr. Smart’s account grew so much is thanks to compounding interest. Compounding interest is when the money you made is making money. $10,000 * 4% return (7% - inflation) = $10,400 which is an increase of $400 in the first year, then the second year is $10,400 * (4% return) = $10,816 which is an increase of $416. Compounding interest allows the increases to have increases...Inception?

So inflation takes the same money in a savings account and makes it worth less (even though you didn't spend anything) and compounding interest takes the same money in an investment account and makes it grow faster and faster (without saving anything). You know inflation is bringing your money down, you know you need your money to grow, and you know investing is the solution for growth so now let's go through some advice on how to start your investing.

Wealthy People Invest and So Should You

Hopefully I have convinced you that investing is a good idea and if you don't believe my take on it, why not check into 99% of wealthy human beings and see if they invest...spoiler alert: they invest a lot. Now you need to know what kind of investing you want to do. There are individual stocks, ETFs, mutual funds, IRAs, and 401ks that all move based on the stock markets. Yes, I said markets (plural) because you can invest in the U.S. stock market as well as international markets.

There are also investments in things you can invest in that don't have as strong connection to the stock market like real estate. These can be bought in shares just like stocks and are often called alternatives. This is the point where most people see all these options or accidentally stumble onto CNBC and see a thousand numbers with charts going all over the place and they think "Ain't nobody got time for that!”. Don’t fear, there are some extremely simple ways to invest and now I’ll walk you through those steps.

Take The Match First

First, if you're company offers a 401k program with any percentage match do that immediately. If the company offers 5% match it means that if you will automatically deduct 5% of your pay and have it invested then they will put the same amount of money in there for free. Example: If you make $4,000 a month on a paycheck normally and decide to participate in a 401k match program of 5% your paycheck would then be $3,800 and your 401k account would get $200 from you and $200 from your company which means you now have $4,200 instead of $4,000. There's nowhere else on earth you're going to get 100% return on investment so that is step number one.

Roth V.S. Traditional

With 401ks and IRAs there are two different flavors (Roth and Traditional). Roth accounts tax the money before it goes in but any interest they earn won't be taxed when you withdraw it, while Traditional accounts go in tax free but then tax it all when you withdraw it. Roth accounts will also let you withdraw any of the money you put in without penalty but if you touch any of the earnings before age 59.5 you will have to pay the penalty.

Traditional accounts are completely hands off until 59.5. There are some exceptions like when you get ready to buy a home. To pick between the two you'll need to consider what tax bracket you are currently in and what tax bracket you will be in around retirement. Personally I assume I am currently in a lower tax bracket than my retirement tax bracket so it's better to pay the taxes now (Roth) but a few years from now I believe I will cross into a higher tax bracket than retirement and will transition to deferring taxes (Traditional).

Because Traditional accounts are pre-tax they lower your taxable income according to the IRS. So if you make enough money that it puts you into a high tax bracket you can put money into a Traditional account to lower your tax bracket. These are all great ways to invest for your golden years in a very tax efficient manner but if you're following the Savings Sherpa you will be looking to fill that 15+ year gap between retirement and 59.5 when your 401k/IRA becomes available. So let's now cover the investing that will provide for you during those early retirement years while your buddies are stuck in a cube farm.

Buying Stocks Is Great But Don't Get Greedy

Investments such as individual stocks, ETFs, mutual funds, etc. are often referred to as taxable accounts. It can be extremely daunting to pick any investment in this realm, especially those individual stocks. If you decide to go down that path, you'll probably want some advice from an expert. These types of investments require you to pay taxes on all the earnings in the year it was received. The most important aspect of these investments is that they are available anytime unlike 401k/IRA, and will fill the gap between your early retirement date until that 401k/IRA money can kick in at age 59.5.

The position of this blog will always be to increase the likelihood of an early retirement. This is done through high savings and steady returns. This is one of the reasons I would eliminate the strategy of building the majority of your nest egg on individual stocks. Individual stocks are much more volatile than the overall market so they could make you rich or leave you out on the street. I like to use about 5% of my portfolio on these higher risk options.

Why not go for a little more risk? Risk equals returns right? The average return for the overall stock market from 1950-2009 adjusted for inflation was 7%. With an aggressive savings strategy this 7% return is going to be plenty to allow for an early retirement. This means individual stocks would introduce risk that isn’t necessary just to be greedy if you can manage the high savings rate.

So you are saving aggressively, you know that you need to invest to combat inflation, you meet your employer 401k match or max out your IRA, and now you want to take advantage of the long term 7% steady returns from the overall stock market. So where can you turn? Well how bout I just tell you.

How to Get Over the Fear of Investing

The key to getting compounding interest and more predictable 7% returns is time in the market (not timing of the market). To get the most time we must avoid "paralysis by analysis" or simply overthinking instead of acting. To do that we need some simple venues for you to invest. This is where something like Betterment can come in. Betterment has no minimum to begin so even if you only have $100 you can begin investing. If your account is under $10,000 it is best to set up an automatic deposit so you can lower your fees.

Betterment builds your portfolio using low cost funds that track the overall market and pay dividends (money a stock pays you even when the stock goes down) all while it automatically diversifies your investments for you. This is a really good option if you're too intimidated to transition from the piggy bank to investing. This is exactly the position I was in less than a year ago so there's no shame at all in that. Betterment's fees 0.25% for all accounts.

They aren't too bad, but I found out after a few months that there is a way to do it better. It would be a little more complicated, but if I cut out the middle man (Betterment), purchase those index funds myself, and keep the same amount of diversification then it should lower my fees. I know this can be done because I have recently done it.

Anything You Can Do I Can Do Better

To keep its fees so low Betterment uses certain index funds, a lot of which come from the investment company Vanguard. Vanguard has all kinds of index funds with fees as low as 0.05%. Going from 0.25% to 0.05% fees may not sound like much but it can really add up with compounding interest as mentioned earlier. Now how do we choose how much of each type of fund we need to be properly diversified? What I did was take a look at the portfolio Betterment built for me using an amazing and free online tool/account called Personal Capital.

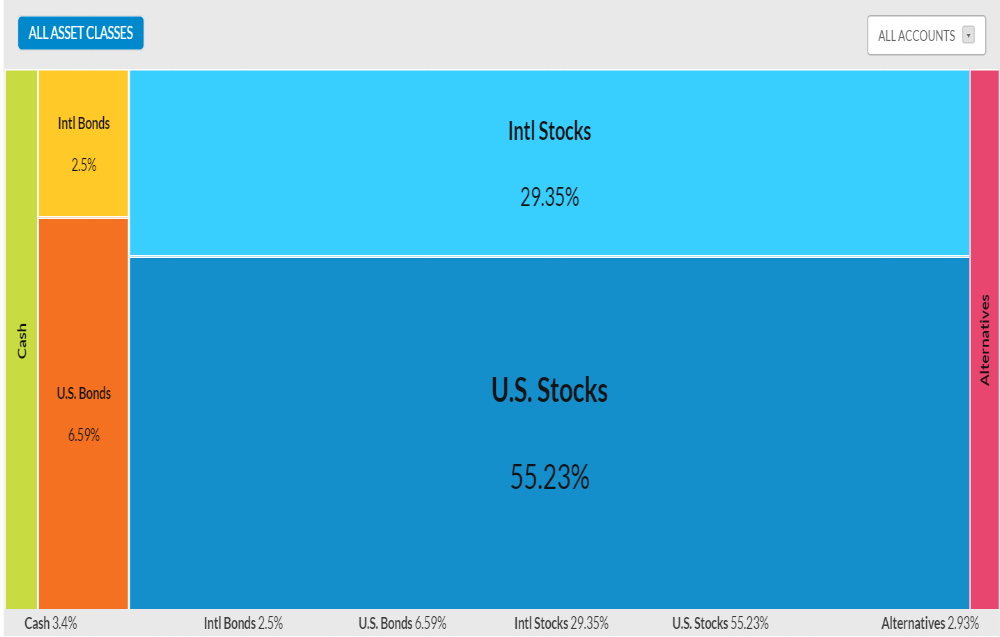

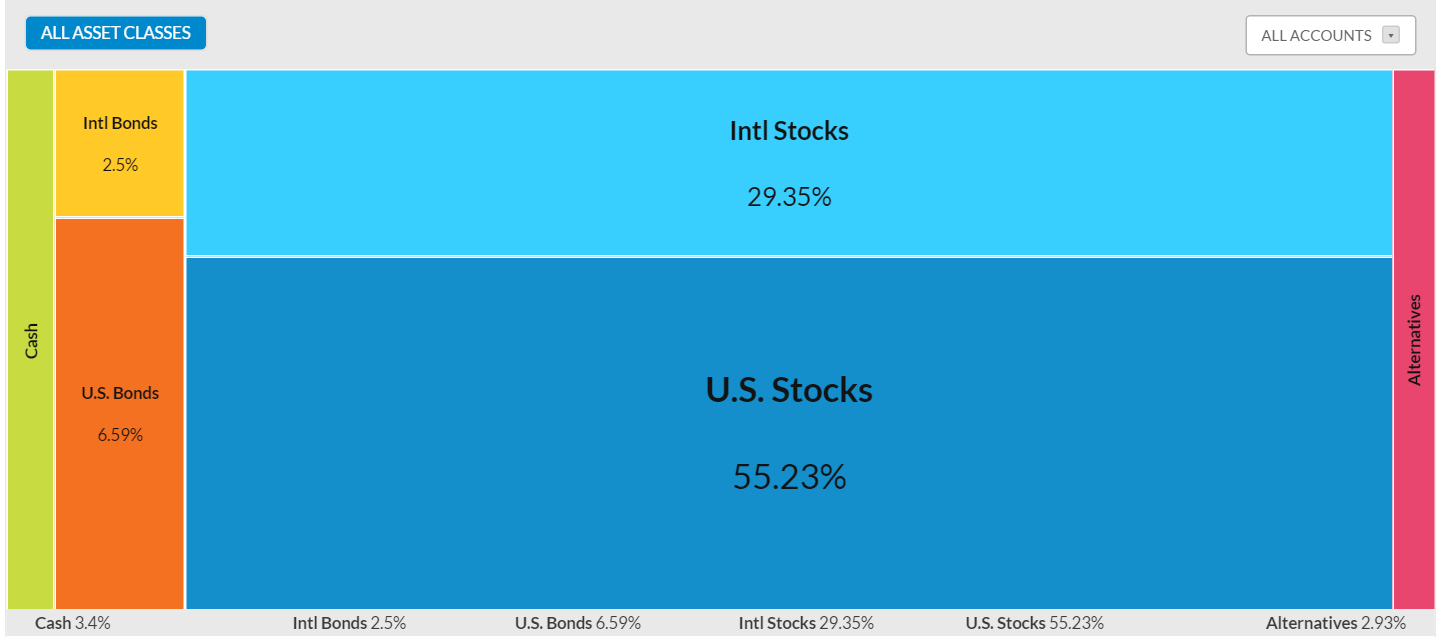

I've mentioned Personal Capital before as a way to track the value of all your accounts in one easy to use website but it is much more powerful than that in regards to investing. Personal Capital has an allocation tab underneath the portfolio section that shows you exactly what percentage of your money is in each type of investment. Below you will see the allocations I currently have. Discussions on exactly how you get to this allocation would be its own blog post but this is a very good allocation for being somewhat aggressive (low % of bonds) while being safe (extremely diversified, low cost, and dividends).

Now that we know how much money should go into each section we can go straight to Vanguard and buy our funds directly. Once you have an account you'll just type in the ticker symbol and buy as many shares as needed. For U.S. stocks you can use VTI (that's a ticker symbol). For International stocks you can use VEU. For Alternatives (like real estate) you can use VNQ. Then for Bonds you can use a mix including MUB. So if you had $10,000 you could buy $5,523 of VTI, $2,935 of VEU, $293 of VNQ, $909 of some different bonds, and $340 to put in a cash account. That will get you on a great sustainable path to investing and early retirement. It is my hope that you are now clear on what you can do, why you need to do it, and that now is the time to do it.

RECAP:

- Inflation means your money isn't worth as much next year as it is today

- Take advantage of employer match without question

- Compare current earnings to future earning and take advantage of tax efficient accounts (IRA / 401k)

- Start investing right away in stable index funds with low fees for your taxable investing

- Use online accounts like Betterment if you're feeling intimidated

- Use Personal Capital to keep up with your allocations

- If you feel comfortable, go out to Vanguard and buy your index funds directly

- Keep feeding the machine and never withdraw any money

Thank you for reading. If you liked what you read please share this post on Facebook, twitter, or just with your friends. If you want to make sure you never miss a new post, sign up to the newsletter below. And don't forget to comment with questions, corrections, or suggestions.

I do not make any guarantee or other promise as to any results that may be obtained from this content. No one should make any investment decision without first consulting his or her own financial adviser and conducting his or her own research and due diligence. Saving-Sherpa.com disclaims any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.