How to Create a Budget

Creating a budget and documenting it are the most important parts of your financial independence journey. Without this you will never be able to calculate your spending or savings rate. Spending and savings rates are needed to calculate how much money you will need to retire and how long it will take you to reach that number. Today will not be focused on maximizing or lowering your budget instead this is the simple step of getting your initial budget. Below we will walk through some simple tips to getting your budget set up.

The first thing you should do is calculate your monthly income after taxes. On this blog you can always assume that all values listed are calculated after taxes. These are the only numbers relevant and allow you to compare your numbers to someone else regardless of special tax circumstances that stem from marriage, state of residence, or profession. Your income number will be used to calculate your savings rate.

The real budgeting starts when you calculate your spending. I highly recommend purchasing everything with a rewards credit card or debit card to make tracking purchases easier. I know that if I have $100 in my pocket and a week later have $20 there is almost no chance I can tell you what exactly happened to that $80. Make sure you link your credit card to your bank account and set it up to automatically pay the entire balance every month. If you do this and choose a card with no annual fee you will get paid to purchase things all while increasing your credit score. Before you get too worried about setting a goal for a savings rate or calculating your retirement date, you should take at least two months to document all your spending to get a ball park idea of where you are.

There are several good tools out there to help you see where your budget currently is so that you can begin creating your new and improved budget. Of course I would recommend my own Basic Budget Tool first. I must warn you that this tool should be used on a computer because it doesn't look so pretty on a tiny phone screen. It may look intimidating but I assure you it's simple and if you have any trouble just let me know. This tool will ask you to pick a savings rate (may need to adjust after a few months), enter your monthly post tax income, and your current net worth. Then you will manually input every purchase into its designated category. I believe there is a real psychological benefit to manually inputting each purchase. This forces you to watch your savings rate go down every time you make an entry. I log on to my credit card once a week and input all the charges which takes about 5 minutes. There are some screenshots at the end of the blog showing the Basic Budget Tool used with the given example.

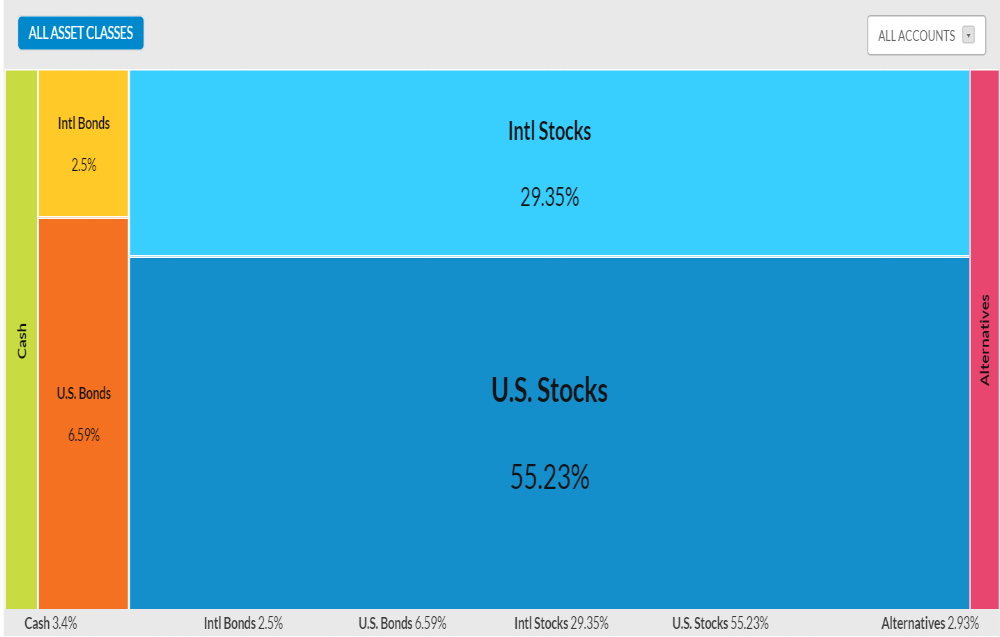

There are also some automated tools out there to help you get started but be aware that it's almost impossible for an automatic system to put your spending or incoming cash into the correct categories. I really like Personal Capital because it can show your spending as well as really in depth information on your investments and allocations. Another really popular tool is Mint. I would say Mint is more geared towards simple tracking of spending while Personal Capital is better once you have investments and are tracking your spending on your own. I use Personal Capital to give me one website and one login for checking the current balance on all bank and investment accounts...really handy since I now have SIX but that's another blog all together.

After you track your spending over a couple months you can begin to construct your new budget. I'll use some arbitrary numbers along the way to make it easier to follow along. First take your monthly post tax income ($4,000) and subtract any unchangeable expenses. These would be things like rent under your current lease, child support, or payments under an ongoing contract. Say $4,000 income minus $700 for rent, $50 for gym, $50 for cable/internet, $50 for cell phone, $100 for utilities and $125 for a charitable sponsorship leaves us at $2,925. Then take all your non monthly payments (car insurance, health insurance, yearly memberships, etc) and divide them by 12 (for a monthly equivalent). Let's assume $1200 car insurance, $1000 health insurance, and $100 amazon prime membership comes out to $2300 or $192/month leaving us at $2,733. This $2,733 is our trade space between money we can spend and our savings percentage. For aggressive early retirement I recommend no lower than 40% which allows you to retire in 22 years (that math is another blog coming soon). If we went with 40% (.4*4000) we would need to save $1,600 leaving us at ($2,733-$1600) or $1,133 a month to spend. If you have ANY debt that is charging you interest you put as much as you can stomach towards that before worrying about saving a single penny. All these numbers and percentages are easily calculated for you using the Basic Budget Tool. So where does the $1,133 go?

Now you have knocked out your uncontrollable monthly bills, set aside money for annual bills, and saved 40% of your check so it is time to spend that last $1,133. These will be your non-standard spending like gas, grocery, eating out, travel and miscellaneous charges which can greatly differ from month to month. Let's say $80 for gas (do they even charge for gas anymore?), $180 for groceries, $100 eating out, $300 plane ticket to Florida, $150 Air BnB for the weekend, $100 on clothes (I'm running out of ideas to buy), and $223 worth of parts for your sweet 1988 Suzuki Samurai. I would hope you agree that these purchases don't sound like someone being extreme or obsessive with saving and still managed 40% savings. The only reason I threw in this scenario was to show you that it is very possible to save way more than you ever imagined and still live a fun life with trips an luxury purchases. Once you see how capable 40% savings rate is you can try for 50%, saving that extra $400 a month could shave 5 years off of your working career. Hard to put a price on 5 years of your life but I just did.

Obviously everyone's situations are different but the principles are all the same. You make a certain amount of money, you have certain bills that must be paid, and then you decide what to do with the rest. The real difference comes from how you alter these principles. Do you trade living alone for a roommate so that you can retire 5 years sooner or the ability to fly somewhere once a month? Do you get off of that normal cell phone plan and swap to Google Fi? Do you meal prep instead of spending the average of $24.74 a week just for lunch/coffee at work? Most people have no idea how much money they spend and can't begin to make these trade-offs until they set down and really track their spending. Heck, you'd be amazed at how many people don't know how much they really make. When I tell people I want to retire early they tell me it can't be done but math says I can, they tell me they couldn't give up "living" life but my personal spreadsheet shows a plane ticket purchase in nearly every month, a Mexican orphanage sponsorship, masters classes and I still have maintained a 58% savings rate for a year straight. It's no different than when people tell you they are eating healthy but can't lose weight. Can they actually show you how many calories they take in? Always trust numbers over opinions, and I challenge you to go get your numbers and then as 50 Cent once said, "let them hate and watch the money pile up".

RECAP:

- Find out what you make after taxes

- Find out what you really have to spend

- Lookout for those payments that may not come every month

- Pay off all debts that charge interest before padding your savings

- Save 40% or more if possible

- Look for ways to shave off the money on remaining categories

- TRAVEL!

Below is a screenshot from the Basic Budget Tool that shows the scenario listed in the blog. The only numbers I put in for the specific month where the individual purchases and account balances. All other statistics were created automatically. The savings rate goal, net worth, and monthly income were inputs for the start of the year.

Liked what you read? Sign up for updates to future posts below!