2017 Budget Review: What It's Like To Save Over 70%

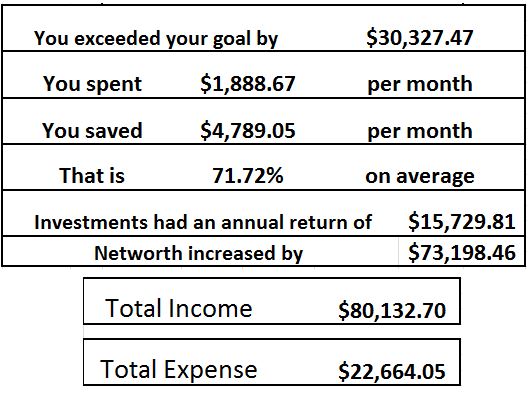

This is the nerdiest time of the year for me. I watch all year as my numbers take shape but they’re not actually final until March 31st. This just happens to be my fiscal year because I started tracking my spending April 1st 2015. When I started, I had $38,200 and an intense motivation to become financially independent. For me this passion is rooted in a desire to never miss out on friends, family, or just life in general. That first year, I was extremely proud to reach a savings rate of 61.5%. Going into this past year, I thought I could do better even though that was above and beyond my goals. Through some favorable breaks and mindful spending I was able to finish this year with a savings rate of 71.7%. I define savings rate as the money after taxes I bring home, minus my spending, divided by my money I bring home. Now, I will unfold the story of how that actually looks and hopefully dispel some misconceptions along the way.

Monthly Travel Expense: $323.43

For travel, I averaged spending $323.43 per month. I think you learn a lot about me and my philosophy when you realize that I spend more on travel than eating out, groceries, and gas combined. My focus has never been on spending the least amount humanly possible or I would never eat out, never travel, and never go to events. Instead, I believe that we should maximize every dollar and prioritize our spending on memorable experiences. If an event sounds fun to me and isn’t astronomically priced, I’m going to say yes 99% of the time. I went to several large concerts, professional sporting events, took 8 personal flights, went skiing, vacationed in Mexico, took several busses back and forth between Boston and New York, comedy shows, financial conferences, snowmobiling, The Preakness, beer fests, two scuba diving trips, and more. I hope this is proof that you can save money and still live a very full life.

Charity

If you ever feel like giving to a great cause but aren’t sure where to turn, give Ciudad De Angeles a look. They’re a very unique and dedicated orphanage in Cozumel, Mexico doing some great things. I personally sponsor one of the kids (Norma) and travel down at least once a year for a mission trip on their campus. I pay $125 per month to sponsor Norma and have been lucky enough to be completely covered through fundraising for my mission trips. I have personal struggles with this category because I want to do more now and realistically I could. But the logical side of me believes it is more important that I set myself up for early retirement so that I can dedicate my time for many decades instead of simply some money. I’d like to think it’s my interaction that truly makes an impact on Norma and the money I provide is just an added bonus.

Monthly Grocery Expense: $66.83

This is the category that absolutely freaks everyone out and someday I hope to do a meal plan series with recipes, pricing, and even nutrient values. For the past year, actually the past two years, I’ve averaged just over $60 a month for groceries. I averaged $66.83 to be exact for this previous year. I don’t have exact rules of thumb but I definitely have some tendencies. I eat a lot of chicken breasts and eggs. They’re so cheap, healthy, and full of protein. I rarely buy anything prepackaged or with much of a shelf life. Think fresh fruits, vegetables, and raw meats. It’s weird because when I tell everyone my grocery expenses, they think I must live on ramen noodles or starve myself, but at the same time I get made fun of at work for bringing in these big home cooked meals for lunch. You can have plenty of food with plenty of quality while saving plenty of money. I even proved it could be done living out of a hotel in Australia (click here to read about that). Shop for what’s on sale and not some predetermined list you have, cut out ingredients in a recipe that really aren’t adding much, and never waste anything. Those rules will get you on the right track for sure.

Monthly Eating Out Expense: $124.94

For eating out I averaged $124.94 per month. In this category I list anytime I go to a restaurant, order something for lunch, go out for drinks, or even buy drinks for the house. I view eating out as purely a social activity. If I’m going to be eating by myself, then I plan on eating food I prepared myself. Eating out doesn’t actually give the time saving convenience that most are led to believe. I can easily bake an entire pan of chicken, a pan of vegetables, and several potatoes in about 45 minutes for five days’ worth of lunch. I could repeat and do something similar for five days’ worth of dinner. I find it hard to believe that you would save much time eating out when you’re only averaging 9 minutes per meal on cooking. It’s also way cheaper and so much healthier. I honestly feel better eating home cooked meals and they are substantially better tasting than those sad $8 lunches I see floating around the office. When going out, don’t be afraid to split a meal. It will alleviate that terrible feeling you get when you overeat and leaves extra money in your pocket to either save or increase your frequency of eating out. All in all, just don’t assume what everyone else is doing is the best. That is probably true for almost everything in life.

Monthly Standard Bills Expense: $685.35

My bills, which are largely rent, utilities, and insurance, averaged $685.35 per month. This is the category that most could see the largest benefit from maximizing. If you don’t have a family, you should probably consider roommates. If you do have a family, you could probably live in a much smaller or older home. If I have an oven and a bed, I don’t need much else. I just don’t have the time to notice any real impact of living in a luxurious place. By the time I come home, eat, do homework, and pack my things for the next day, I don’t really have time to admire the backsplash on my kitchen sink or that extra guestroom that’s full of moving boxes. I’ll admit that I don’t live by extremely simple means. I do have a 50” and a 60” television, but I use them and they have lasted and will last for years. It’s an unneeded pleasure that I enjoy and that I use, so I can live with that. This category will certainly increase for me in the year to come because now that I’m just outside of Boston, my rent has increased to $775 from the $500 I was paying in Colorado Springs.

Oddities: Good and Bad

Life throws you curveballs both good and bad and this is especially true in finances. This year I had a few good breaks or positive oddities. The biggest oddity was the extra income I earned by traveling to Australia for work. I was able to save $6,000 post-tax after paying any expenses related to the trip. I was lucky to have the opportunity but I also maximized it by cooking in my room and finding low cost adventures. I’m seeking my master’s degree and spent $112 a month between tuition and books. The bright spot is how cheap that is thanks to the Air Force but it’s an expense that won’t last forever so it’s still an oddity. I also had large expenditures fixing up my 1988 Suzuki Samurai and buying $1000 worth of new camera equipment. You'll see the odd expenses fall into my miscellaneous category. These type of expenditures and incomes are hard to plan for. Understanding what these “life happens” moments actually look like should help when planning your retirement.

In Summary

Overall my expenses did increase $150 per month from 2016. I’m actually happy with that because my savings rate went from 61.5% to 71.7%. This signifies that I was able to fight off the temptations that often come with a higher salary. If I can continue that throughout my career, I will be financially independent soon and have the flexibility to live by simple means and be comfortable doing so. Not everyone has the opportunity to save at a rate as high as me and that is OK. The important part is understanding what you are saving, how much more you could save, and how all of that effects the plan for your life into retirement. I hope to make speaking out about our personal financial situations less taboo by speaking out about mine. I hope that someday you can ask your friends about their net worth or spending the same way you’d ask about their 5k time, and challenge each other as well. Be creative, take control of your reoccurring bills, and stick to your plan. These simple rules of thumb will have you well on your way to transitioning from an office chair to a lounge chair.

If you want to track your spending in a simple way that provides great statistics like the ones below, then you should download my free budget tracking tool.

DOWNLOAD BUDGET TOOL

I do not make any guarantee or other promise as to any results that may be obtained from this content. No one should make any investment decision without first consulting his or her own financial adviser and conducting his or her own research and due diligence. Saving-Sherpa.com disclaims any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.