3 Simple Steps to Retire When You Want

Most of us will never be slinging Yeezys

No one wants to work forever and we all have big dreams of being the next Mark Zuckerberg, Elon Musk, or maybe even Kanye, but unfortunately most of us will never be slinging Yeezys for a few hundred bucks a pair. Working in a cube farm until 70 may seem fine for Larry in HR, but if you’re reading this then my guess is that you simply can’t settle for that. So what then for the rest of us? How about grow up, make some money, be smart, and retire 20 years before society thinks it’s ok to walk away from the corporate life. This article is going to walk you through setting up a plan that will have you beach-side daily before your gray hair even has time to show up.

Step 1: Know Where You Stand

Personal Capital is my first tool in the process for laying out a timeline for retirement. This jewel currently has $3 billion in assets that they manage and $270 billion that they track, so just because the name might be new to you doesn't make it some fly by night operator. This tool is amazing for getting a quick look at where all your money and debts are, how they’re performing, and what kind of expenses you’re paying for management fees. It’s a true one stop shop. You can login to all your accounts (savings, checking, brokerage, 401k, loans, anything) and it has beautiful displays and a great mobile app. They use top of the line security measures so no worries there.

Just with this one tool you can already answer a question that very few people I know can answer. How much are you worth? If you actually load in all your accounts, you will know your net-worth right away. With this information you can answer the first critical question… Where are you know? Bottom line: sign up at Personal Capital and input every single account. Next we will look at what led you to this point.

Step 2: Know How You Got Here

Maybe it’s a happy day when you check your net worth, it could be a letdown, or heck you may have no idea if it’s good or bad, but congrats for at least knowing. Regardless of where you are, you got here due to a combination of you or your loved ones' income and spending. The problem, is most people don’t know what that combination is and the following is the normal sequence I run into - QUESTION: “How much do you spend a month?”…. ANSWER: “Not too much”. What the heck does that even mean? Everyone may dream to retire earlier but with that type of planning you might be retiring at death.

Knowledge Is Power

I think everyone understands you’re going to need some amount of money or income to retire and it's true that everyone will require a different number. But, it's impossible to make an accurate projection of how much money you will need in if you don't know how much money you already spend. The easiest way to do this is using a service like Mint or some automated software that will track your spending for you. The most correct/effective/habit changing method however is by doing it manually. While the computer may think you spent $24 for groceries at 7-11 you know it was gas and although you technically paid for the fam's $800 dollars in plane tickets and later got paid back, these automated mistakes can make your expense/income numbers way off.

Manually tracking is going to be much more accurate but that’s probably only half the reason I recommend it. Another huge benefit is the fact that you relive every purchase when you type it in and you watch yourself getting further and further from retirement. This reflection is a great way to highlight the money pits that aren't actually adding any happiness to your life.

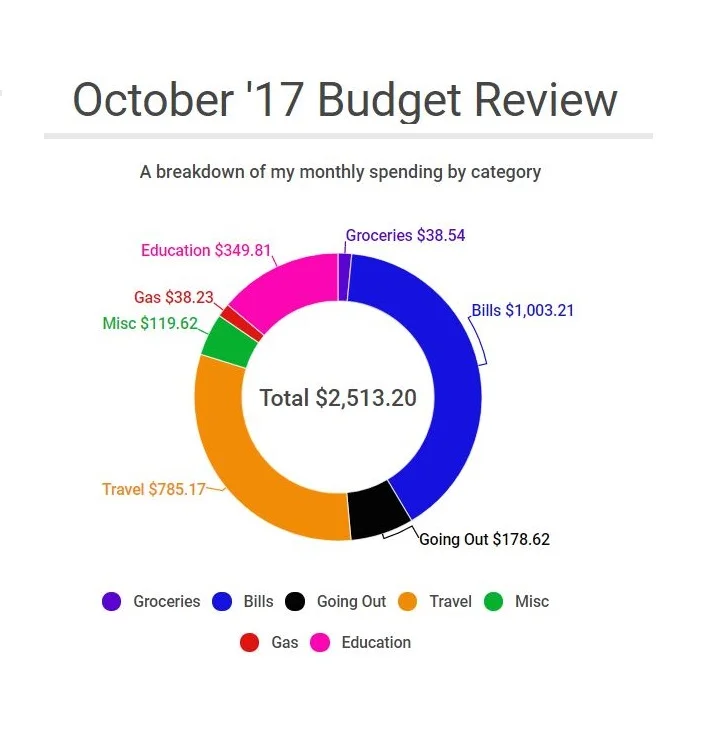

10 Minutes Per Week is All it Takes

The reason most people don’t track their income/expenses is because they think it’ll take a lot of time or effort but it really doesn't. You can handle it with 10 minutes a week. All it really takes is a piece of paper if you really had to, but I suggest using an Excel based tool like The Basic Budget Tool. This tool can also be used in Google Sheets and gives you nice visuals of all your spending by categories and makes goal tracking a breeze. If you make all your purchases on a credit card, then just login at the end of the week and copy down your expenses, input how much you’re making, and all your account totals via Personal Capital. If you do this over 3-6 months you will have a pretty good idea of what the future is going to look like. Bottom line: document your income, spending, and investment performance. This will show you how your savings rate and investments are doing which is critical info for laying out the road-map to retirement.

Step 3: Decide Your Retirement Date

Now you know exactly how much you have today, how much money you have coming and going monthly, and the last piece is to decide what day you want to retire. To do this, we’re going to go ahead and assume a few industry standards according to investing in the overall stock-market with some bonds over a 20 year period. Assumptions include: Every dollar today will become $1.07 a year from now, That $1.07 will buy you the same thing around $1.04 would today because prices always go up, and you don’t plan on actually touching that big lump sum (cue your kids poppin' bottles). With those assumptions, the math gets really easy. For every $1000 you save, you will have $40 a year worth of today’s spending power for the rest of your life and beyond. Let’s say you track your spending and realize you spend $45,000 a year, that means you need a $1.125 million dollar lump sum. That lump sum will allow you to sustain your current lifestyle and give you $1.125 million to leave behind for your family. There are some scenarios where this lump sum could dwindle and many more that could have that lump sum continuing to grow.

Most People Spend Less In Retirement

While that math was hopefully simple, the reality is that you probably won't spend the same in retirement as you do today. There are good and bad scenarios here. The problem comes from those who want to have a second home on the slopes and live a much more lavish lifestyle than they do currently. This is obviously not sustainable with a plan based on your current spending. The positive news is that most people actually spend less in retirement. There are a lot of financial doors that retirement can open for you. We often pay a premium for convenience because our time is so limited while working. When you travel to a different country in retirement you can easily find a 3-6 month lease for much less than a hotel would have cost you on a traditional 5-day vacay, plus your airline costs will probably go down with your added flexibility. Click here for a great example based on Thailand. Deciding how you want retirement to look like takes some soul searching and there is a definite trade off in how long you want to work and what kind of life you want once it’s over. Just remember though, saving an extra 10% now could give you back 10 years of your life so don’t take it lightly.

We All Have Hope To Retire

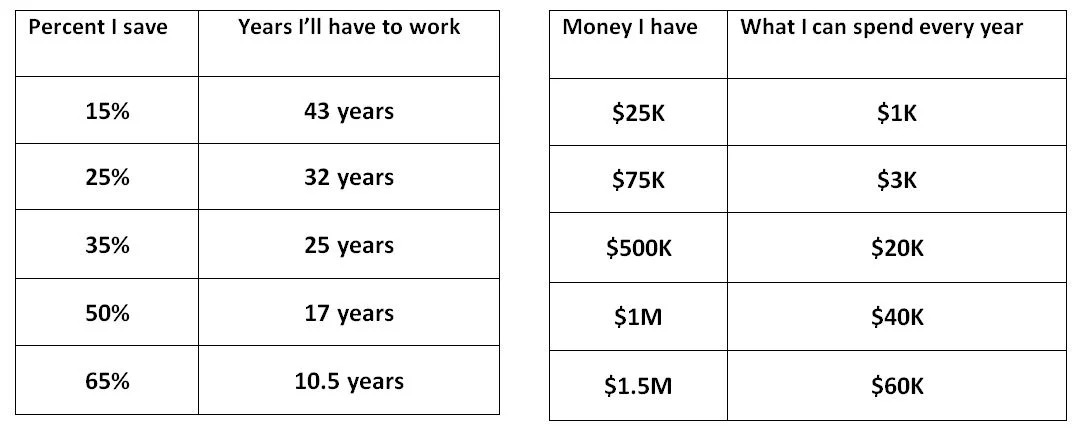

The good news is that it doesn’t take a huge salary to meet some pretty aggressive retirement dates. Below are some tables to help you visualize your retirement date, consider your options, and reinforce why compounding interest is your best friend. Bottom line: Make an estimate with some wiggle room of what you’ll want to spend at retirement, run the numbers in a few calculators, and stay the course.

A Couple Cheat Sheets for Visualization

I do not make any guarantee or other promise as to any results that may be obtained from this content. No one should make any investment decision without first consulting his or her own financial adviser and conducting his or her own research and due diligence. Saving-Sherpa.com disclaims any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.