October '17 Financial Review

Monthly Review: October 2017

I can’t believe I’m typing this but it’s actually the first monthly review I’ve ever done. I find that slightly odd because the whole point of the blog was to give normal people a guide to follow towards financial independence. For someone carrying the Sherpa namesake, I have failed on my guide duties for sure. It’s time to right this ship and start what is hopefully a monthly occurrence for years to come. Ready for some Data?

Income: $7,730

My standard take home pay from the Air Force. No side hustles here.

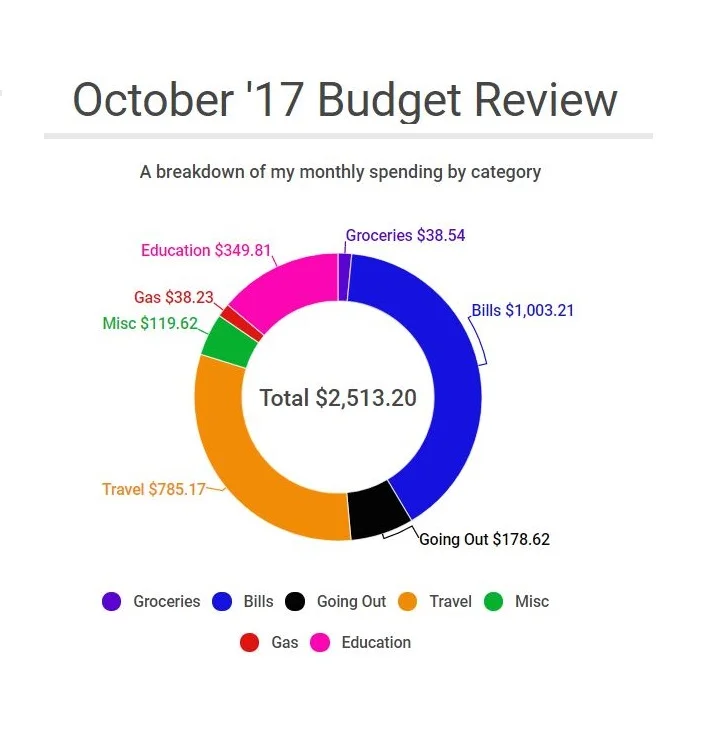

Expenses: $2,513.20

The total this month, $2,513.20, came out a little higher than I expected and did cause me to drop slightly under my 70% savings rate goal down to 69.67%. I’ll now break down the specifics on how I got there.

Going Out: $178.62

This category involves any food I didn’t cook myself or alcohol. I had a lot of trips this month so this came in surprisingly well. Trips included Texas, Vermont, New York, and back to Texas. Around $80 was food and the remaining $98 was for drinks. I just realized that I had chicken and waffles twice which means life is good. Also tried a ton of craft breweries and lived it up down in FinCon.

Groceries: $38.54

Yes it’s a super low number but I was also on the road a lot for work where free food abounds at the hotels. Plus, my average grocery bill for the past couple years is just under $70 per month. I meal prep a lot and you’ll come to realize my staples are chicken breast, sweet potatoes, and eggs.

Bills: $1003.21

Bills, can’t live with them, can’t live without them. This category includes rent ($775), Cell Phone ($85), Car Insurance ($83.21), and utilities ($60). My rent is super low living in the Boston area. I do have roommates but I honestly don’t feel like there’s anything else I need in a home except for maybe a covered parking spot. Some of my frugal friends may hate to see me pay so much for a cell phone but that includes the device payment (I’m a sucker for technology) and unlimited data (soooo nice for us road warriors).

Travel: $785.17

This is the category I don’t get upset about when it gets a little high. It will include any events, trips, or travel expenses. I’m very good at doing fun trips on the cheap but some months just involve a lot of trip purchases. This month’s event purchases include Dylan Scott concert, several rides/trains, flight to Orlando, flight to Iceland, FinCon 2018 tickets, Air BnB, Bus to New York, and the camping and gas fees for a trip to Burlington VT. I document the expense in the month that I purchased not the month that the trip actually occurs.

Education: $349.81

Man I can’t wait for this category to disappear forever. I am getting my Master’s degree and should finish up in March. This total includes the portion of tuition that I’m responsible for after the Air Force pays their portion as well as books and class fees.

Miscellaneous: $119.62

This month’s random purchases were Mario Odyssey (so busy that it’s still unopened) and a microphone to start doing more podcast interviews with.

Gas: $38.23

Fairly self-explanatory category. I have a 24 mile round trip commute in my 2014 Ford Fusion Hybrid. The car was parked much of the month do to travel.

Big Picture: Net Worth Increase $9,093.94 to $198,009.37

Net Worth Breakdown

Out of the $9,093.94 of net worth increase, $5,216.80 was due to savings while $3,877.14 was due to investment returns. Note that in my listing, a negative in the debt column refers to money owed to me and therefore increases my net worth.

I do not make any guarantee or other promise as to any results that may be obtained from this content. No one should make any investment decision without first consulting his or her own financial adviser and conducting his or her own research and due diligence. Saving-Sherpa.com disclaims any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.