How Much Would You Save If Life Was Short?

You Can’t Take It With You When You Go

If you would rather listen to this article, click here now

I’m going to start this article off a little unorthodoxly. I’m going to ask something of you, before I try to give something back.

Answer this question quickly and honestly: If you died at age 50 and had a chance to look back on your life, do think you would wish that you'd saved more or regret saving at all? Great, now remember that answer. We’ll revisit it after I clear up some misconceptions.

While general consumerism is probably the biggest roadblock to strong finances, it’s not the main problem I see with my millennial cohorts. People my age always use the argument: I can’t predict the future so I’m going to live (and spend) in the moment. From the title of this blog, you might think I’m going to encourage you to do just that—forget the savings nonsense and spend what you have while you have your health. But as Lee Corso would say, “Not so fast.”

Let’s look at two different scenarios.

I recently discovered that two people I care about are up against some extreme medical conditions. It’s heartbreaking to see two people so close to retirement be robbed of their health, but that’s what got me thinking about how I could plan for the same scenario. The thought of having my health deteriorate in my sixties is a powerful thing to keep me focused on my financial goals. And it may be weird to think about wanting to save more even if your life expectancy or good years are shortened, but stay with me.

Let’s create two simple scenarios. The first is called the the “Typical Scenario” and the second is the “Sherpa Scenario.” For both scenarios, the person will live to be sixty. And to keep it realistic, they won’t actually know their expiration date.

The person in the “Typical Scenario” has adopted the Carpe Diem mentality—aka “You can’t take it with you when you go.” This person dines out frequently, can’t be bothered with altering their plans to align with deals, and frequents luxurious locations in resorts for a couple days here and there as their corporate schedule allows. They still work 50 hour weeks, all while continuing their path to a retirement at age 67. Which also requires saving BTW. Then, they unexpectedly take a turn for the worst and never reach 61.

You’ll have some good times, but you’ll miss some great times.

It was a solid life with some cool experiences. It also never involved an escape longer than two weeks. The Typical member missed their nephew’s high school graduation because of a last minute work trip. They missed most of their dad’s last 8 good years with only time for a couple visits. It was good life with some good memories and even a few unforgettable moments, but it always felt a little held back by that Monday morning alarm that reminded them of work to come.

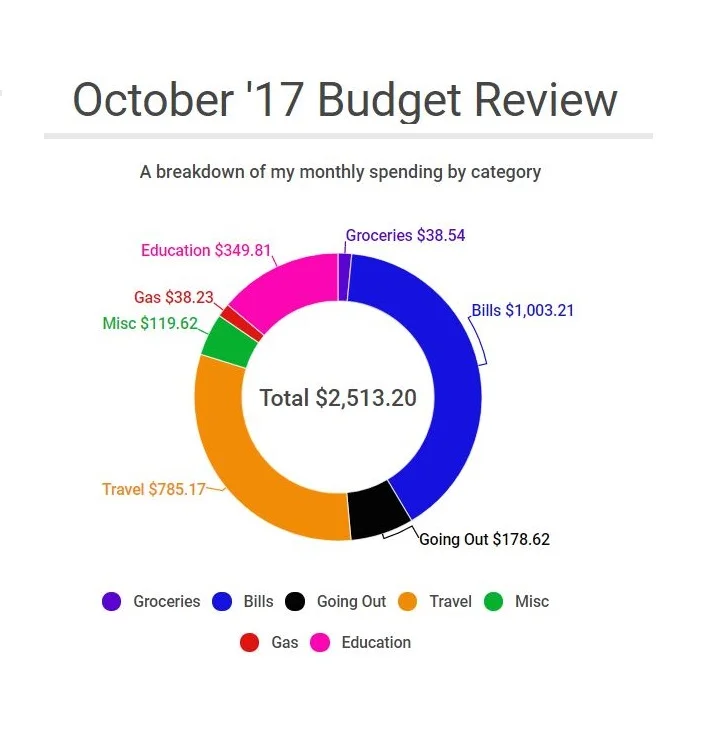

Now for the crazy “Sherpa Scenario.” The Sherpa member always meal prepped from sale items. They said yes to the events that were extremely important to them, but let the frugal experiences fill the gaps. When going on vacations the Sherpa member made sure to pick “off season” and stay with local families through Airbnb type arrangements. While rooms may not have always been air-conditioned, neither were the world class beaches that they were sitting on. The Sherpa member saved, saved, and saved some more. Saving 40% or more of their income. Doing so meant a couple sacrifices such as “super close neighbors” aka roommates or “pregaming” with food before a night out so they could enjoy their friend’s company over a beverage, but avoid the extra $15-20 calorie fest. Small sacrifices that culminated in shocking co-workers with a retirement date prior to their 44th birthday.

Now, the fun part--Life after work

After 44, the person living the Sherpa lifestyle no longer has a work week restricting plans. Now, instead of 1-2 week vacations, they go for 4-6 months. The flight is actually cheaper due to the flexibility of when they can fly. It’s long enough for a short term rental which will cost the same or less than their standard rent. They become immersed in the locations they visit and feel no rush. The Sherpa member now gets a ton more vacation with no additional cost. It’s all possible when you give someone the freedom of time. They never miss another wedding, birthday, Mother’s day, graduation or funeral. And they keep this going for 17 years until they unexpectedly lose their health at age 60.

Can you imagine how many more interesting memories there would be in the “Sherpa Lifestyle” vs the “Typical Lifestyle”? Another crazy thought is what it would look like if the person in the “Typical Scenario” didn’t croak at age 60. They’d be 84 (Age 67 retirement + 17 freedom years) before they could catch up to the Sherpa member in truly free years. Even then, would it really be the same? Would you trade retirement during ages 43-60 evenly for ages 67-84? I don’t think anyone is taking that offer.

Still Not Convinced?

So maybe you’re thinking, “Well 60 is still kind of old.” Alright, let’s kick it up a notch. How about dying by age 50? Keep in mind, the chances of someone who has already made it to age 21, not making it past 50, is about 5% in the United States. What if you did all that saving for 7 measly years of retirement? As always, numbers are our friend.

There are about 261 work days in a year, so that comes out to be 1827 additional vacation days that you would have at your disposal over that “measly” 7 years of retirement. To put that into perspective, if you received 15 vacation days per year for 29 years (age 21 to age 50), that would only be 435 days. So in 7 short years you would have over four times the vacation days than the previous 29 years combined.

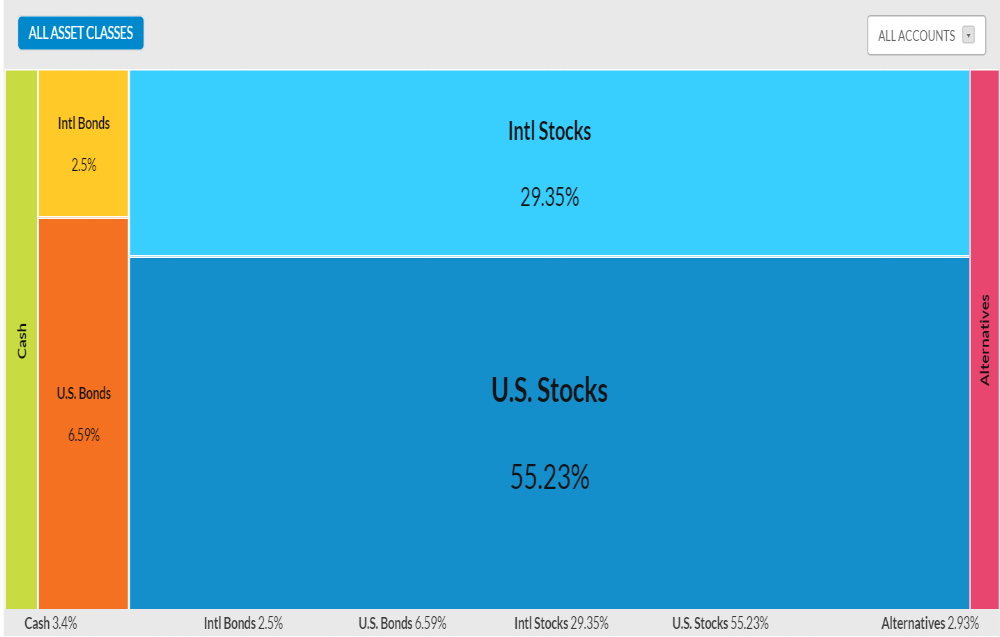

The truth is, we obviously have no idea how long we have on this Earth or how much of that time is going to be enjoyable. What we do know, is what we stand to potentially gain vs potentially lose. If changing your lifestyle can be done without noticeably diminishing your happiness and quality of life, and it also comes with almost two decades of prime year potential, then I think we have an obvious win here for the Sherpa member.

Balance is Major Key

The trick is finding the balance between expense and experience. Say yes to meaningful experiences and no to money zapping time killers. You must avoid depriving yourself, while also challenging what you believe deprivation really means. To focus on the outcome you’re looking for instead of a specific pre-diagnosed way of getting there. Is the vacation experience heightened by a fancy lobby? I would hope not. Does the food you go out for at lunch make you feel good and keep you in line with your health goals? Doubtful. If you want a beach, a mountain, a great lunch, or a drink with a friend then by all means do it, but learn how to do it as efficiently as possible. Doing so will put you in the best position to maximize your wealth and therefore maximize your life—regardless of the path it may take or how short that path turns out to be. You don’t have to choose between seizing the day and seizing freedom, you just have to seize wisely.

So, I’ll ask a familiar question one more time: If you died at age 50 and had a chance to look back on your life, do think you would wish that you'd saved more or regret saving at all?

There’s no right or wrong answer, just what works for your life. But, my hope is that after understanding the “Sherpa Lifestyle” you may reconsider your choice.

If you liked this, then check out these:

Don't forget to comment and sign up for the newsletter below!

I do not make any guarantee or other promise as to any results that may be obtained from this content. No one should make any investment decision without first consulting his or her own financial adviser and conducting his or her own research and due diligence. Saving-Sherpa.com disclaims any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.