Dec 17 Review Plus 2017 Annual Report

Monthly Review: December 2017

You may be wondering why this is just a monthly review and not a year-end review like everyone else. The reason is that I started my FI journey and budget tracking in April of 2015. Because of this, my fiscal year runs from April-March. Most of my blogging buddies would probably be quick to let me know how much of an idiot I am by not capitalizing on this time of year but it’s just now how my story unfolds. To scratch the itch I will give y’all a quick calendar rundown but you’ll have to wait until April to get the real deal. Alrighty, lets jump into the numbers.

Income: $9,150.81

This one isn’t quite as cut and dry as normal. The reason is just do to timing that works itself out over the course of a year. Much like a 401k, the Thrift Savings Plan (TSP) that is available to government employees is limited to $18,000 per month. You set how much you want to contribute every month based on a percentage. Well it's basically maxed out in November and therefore none gets taken out in December. But, my contributions always show up a month later because of the processing timeline. So income this month looks high this month and will look low next month. No biggie, it’ll all average out

Expenses: $1,904.06

The total this month was $1,904.06. I find that December is always a lean month for me because I’ve already bought my travel tickets and Christmas presents. Plus, a good portion of the month is spend with family which doesn’t come with a lot of expense. I had my quarterly payment ($375) to the orphanage I support (Ciudad De Angeles) and my yearly squarespace dues ($144). All in all, a sub $2k month after moving to Boston is a win.

Going Out: $50.45

This category involves any food I didn’t cook myself or any alcohol purchase. Pretty proud of myself on this one. Me and my girlfriend continued our tradition of vacation in December instead of overdoing presents. We went down to Universal Studios in Orlando for 4 days. Luckily our AirBnB had a well equipped kitchen so we didn’t eat out much, we both got $20 gift cards for a short survey while down there, then we split the expenses that actually came about. Also, shout-out to the $10 pitchers of margaritas in Mississippi.

Groceries: $38.29

A lot of time this month was spent on the road and I decided to try and clear out some of the meats I’ve had in the freezer for quite some time. Throw in a couple work parties with food provided and you have the perfect storm. I won’t lie and say I didn’t get some name brand kettle cooked chips and some good deli sliced cheese on Mom’s dime when I was home for Christmas, but it’s ok to be spoiled a couple times a year right?

Bills: $1162.28

Bills, can’t live with them, can’t live without them. This category includes rent ($775), Cell Phone ($85), Car Insurance ($83.21), and utilities ($47). My rent is super low living in the Boston area. I do have roommates but I honestly don’t feel like there’s anything else I need in a home except for maybe a covered parking spot. Gas and electricity came in at $75 but that gets divided by three. Water and trash are included so the only other thing I pay is internet ($22). Also had my annual squarespace fees come in this month. Some people pro-rate bills like that and spread them across months but I just track things as they come. Simpler for me and all works out over the course of a year.

Travel: $200.98

I classify entertainment and travel related expenses in this category. This category is pretty low for me this month. I do have an Iceland trip coming up in a couple weeks but some expenses for it had already been paid and some will be paid next month. I did have a rental car for Orlando, parking at Universal, 2 concert tickets, a work party, two movies for myself, and some for my niece/nephews.

Charity: $375

Just continuing my sponsorship of Norma. This year I was able to send her Christmas presents down via Amazon which was a nice change to packaging them up and shipping them to a central location for yet another shipping run.

Miscellaneous: $42.41

The annoying catch-all category that is sometimes hard to keep in check. I’ve actually done much better the last two months. I’ve found it’s never smart to buy that random stuff right before Christmas. Either someone else will get it for you or you’ll be preoccupied by a gift and probably realize you didn’t need it in the first place. This month involved some medicine, Christmas gifts, school expenses, and some items for a deployment care package. Didn’t really buy myself any objects this month.

Gas: $34.65

Fairly self-explanatory category. I have a 24 mile round trip commute in my 2013 Ford Fusion Hybrid. Little less driving this month do to traveling for work, vacations, and holidays.

Big Picture: Net Worth Increase $14,850 to $222,907

Just when I think my net worth jumps can’t get any bigger…they do by a significant margin. It has nothing to do with some grand investing scheme. It’s mostly simple buy-and-hold philosophy with index funds such as VTI and a really aggressive savings rate. Too many people give up before they get to see the snowball effect. It’s so powerful and I can promise, once you see it, you’ll never want to stop. Full transparency, I have purchased about $6k in cryptocurrencies since May. I plan on transitioning my profits from major coin and begin playing with some of the alternative coins. I’m at a safe point where I feel that I can try alternative investments as long as I keep myself to under 5%. When I invested the money it was actually only 2.5%. A lot of different opinions out there but there are worse hobbies to have. Just don’t get greedy and put in money you’re not ready to lose.

BONUS --- Annual Recap

· As I mentioned before, I post my detailed annual reports in April due to when I began tracking back in 2015, but I did some quick numbers for the calendar year that I’ll share with you below what it looked like reaching 71.3% savings rate and a networth increase of $99,138.22.

o Income - $91,922.52 ($7,660/mo)

o Expenses - $26,351.96 ($2,196/mo)

o Rent: $760/mo

o Travel: $515/mo

o Bills: $235/mo

o Misc: $195/mo

o Eating out: $117/mo

o School: $116/mo

o Charity: $73/mo

o Gifts: $70/mo

o Grocery: $60/mo

o Gas: $50/mo

o Saved - $65,570.56 ($5,464.21/mo)

o Investment Earnings - $33,358 ($2,797/mo)

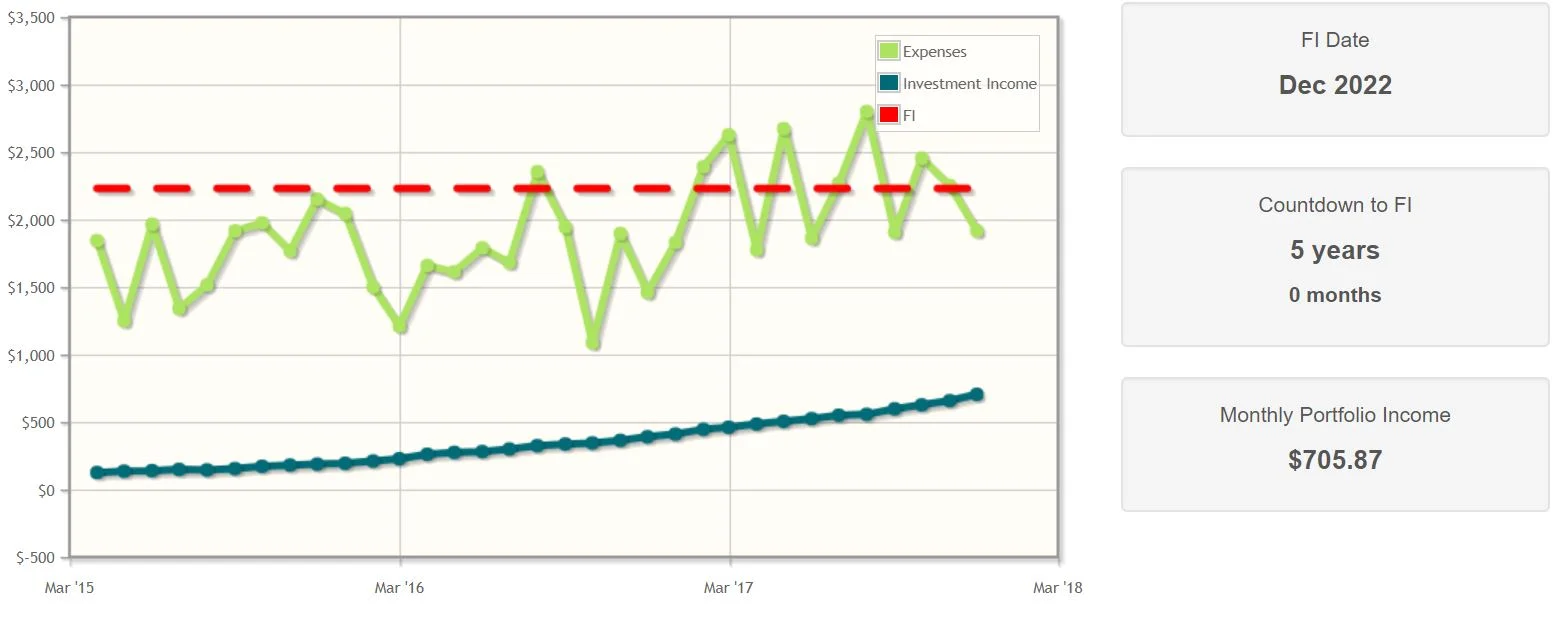

Below you can also see when I would be technically financially independent according to the Mad Fientist

I do not make any guarantee or other promise as to any results that may be obtained from this content. No one should make any investment decision without first consulting his or her own financial adviser and conducting his or her own research and due diligence. Saving-Sherpa.com disclaims any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.